PA18/06111 | Retail Planing Policy Supplementary Advice

Extract

4.Summary and Conclusions

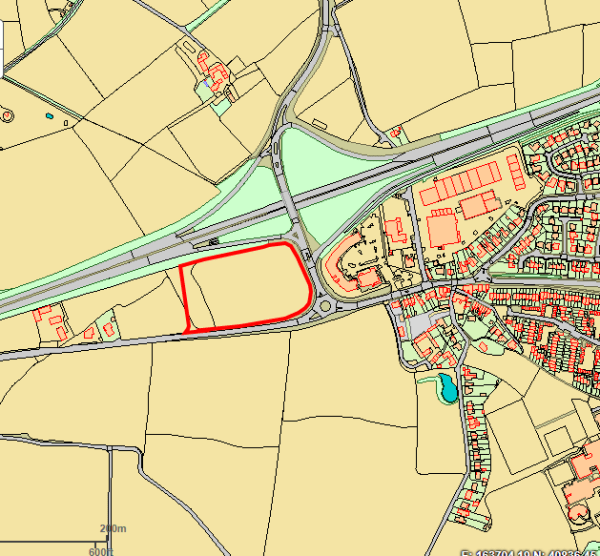

4.1 This supplementary advice report has been prepared by AY for CC in relation to two planning applications for the development of land to the north of Roseworthy Hill on the western edge of the Camborne urban area. These applications comprise:

Application 1 (PA18/06111) – full planning application for the erection of three separate retail units for food and non-food goods sales, along with a petrol filling station (‘PFS’) and associated development.

Application 2 (PA18/06112) – full planning application for the erection of a café/restaurant unit and associated development.

4.2 This supplementary advice follows previous written advice provided by AY (formerly GVA) to CC in November 2018 and takes into account additional information submitted by the applicant in December 2018 and February 2019. This covers additional information associated with the development plan and national planning policy requirements of the sequential and impact tests. Alongside submitting this additional information, the applicant has amended the content of Application 1 to remove the 465sq m Unit A which was intended to sell comparison goods.

4.3 Given the location, planning policy status and scale of proposed floorspace, there is a requirement for the Council to consider whether both application comply with the sequential test and whether Application 1 is likely to have a significant adverse impact upon nearby defined ‘town centres’.

4.4 We summarise our conclusions on both of these tests for each application in turn below.

The sequential test

4.5 In relation to Application 1, the key area of disagreement with the parties to date has been the potential suitability and availability of the bus depot/station site in Camborne town centre. The information submitted by the applicant in December 2018 did not provide sufficient comfort that the bus depot site was not a suitable alternative, although the draft February 2019 P&S document provides a further feasibility study which shows the scale of reduction in retail floorspace and car parking should all elements of the two applications be placed on the bus depot/station site2. It shows significantly reduced retail units of 5,000sq ft and 7,800sq ft at ground floor level and only 51 car parking spaces, alongside the petrol filling station and the café/restaurant unit. Whilst the petrol filling station has not appeared in the applicant’s previous assessments, even if this were to be removed then it is clear that a significantly different scale of floorspace could only be accommodated on the bus depot/station site. Indeed, the issue of suitability and flexibility was discussed in the recent Mall extension proposal in Bristol by the Secretary of State and the presiding Inspector. It was noted that for alternative sites to the ‘suitable’ then needed to accommodate “a broadly similar development proposal” and the applicant’s analysis for this application has have now been able to demonstrate that the bus depot/station site cannot do this.

2 For the avoidance of doubt, the applicant has offered to formally link both applications so that they can only come forward together and thus essentially become one single developmentproposal. In doing so this would suggest that the sequential test can be passed, based upon the above comments about Application 1. We recommend that CC should seek legal advice to confirm (A) whether a suitable legal mechanism, in a Section 106 agreement, can be found to formally link both application in order that they may never be separated, and (B) this provides adequate ‘mitigation’ for CC to conclude that non-compliance with the sequential test should not result in the refusal of Application 2 as advised by paragraph 90 of the NPPF.

4.6 In relation to the availability of the bus depot/station site, the December 2018 document submitted by the applicant did not provide any additional information or analysis. It would also appear that, at the time of preparing that document, no further contact has been made with either CC or First Bus to discuss the potential for relocation. However, the applicant made contact with First Bus in January 2019 and it has been confirmed that “no further discussions have taken place with CC following the informal discussions in September / October 2018”. Based upon these circumstances, whilst there has been a stated aspiration to explore relocation of the bus depot, the lack of progress between Autumn 2018 and Spring 2019 suggests to us that the bus depot/station site is not available.

Impact

4.7 Our previous advice concluded that Application 1, as originally submitted, was likely to have a significant adverse impact upon the health of Camborne town centre. We also concluded that the proposal is likely to have adverse impact upon existing investment in Camborne town centre. Since that advice, the applicant has revised the content of Application 1 and has submitted additional information on the health of Camborne town centre and the trading overlap between the proposals. As a consequence, this advice report has reached an updated view as to whether Application 1 is still likely to have a significant adverse impact upon the vitality and viability of Camborne town centre. In order to reach an updated view, we have taken into account the following factors:

The applicant has amended Application 1 to remove a modest sized retail unit was proposed to sell unrestricted comparison goods. This has had the effect of (A) reducing the direct financial impact of the proposal on Camborne town centre, and (B) reducing the level of trading overlap between the proposal and the town centre. There remains however a large element of trading overlap even with the revised proposal.

There is general agreement between the parties over the scale of direct financial impact of the proposed on Camborne town centre. The impact on the convenience goods sector (falling largely on the ALDI store) is -21%/-22%, the impact on the comparison goods sector is -5%/-6% and the overall impact upon the Class A1 retail sector in the town centre is -11%/-12%.

We consider this to be a large level of trade loss for the town centre and is equivalent to the loss of £1 in every £9 spent in the town centre.

A large part of the trade loss will be focused on the ALDI foodstore. This store, based upon the available survey evidence, trades well and is unlikely to close as a consequence of the proposed development.

The impact on the ALDI store, and its subsequent trading performance, is therefore of relevance in relation to the contribution that it can continue to make to the role and attractiveness of the town centre in the future. There is evidence of linked trips between the store and the remainder of the town centre but disagreement between the parties over (A) the significance of these, and (B) how they will be affected by the proposal. In our opinion, the level of linked trips will reduce as a consequence of the proposal but the ALDI store will remain a popular shopping destination. There is also evidence of lower levels of linked trips associated with out of centre foodstores in the Camborne and Pool area.

There is a need to also take into account the health of Camborne town centre which appears to be fragile. In particular, vacancies across the centre remain high, as they have done for the past several years, whilst the available evidence suggests a lower level of market penetration for the centre across

the areas surrounding Camborne. This has led to a drop in the level of expenditure which the centre is now attracting from certain areas and a static level of turnover during a time period when spending on comparison goods has been increasing.

4.8 Based upon the above, we have reached an updated conclusion that there is proposal will have a clear adverse impact upon the health of Camborne town centre and, based upon the salient circumstances associated with the town centre and the scope of the proposal, the scale of this impact is very close to becoming a significant adverse impact. This is a finely balanced conclusion which takes into account numerous contrasting factors and is influenced in part by

(A) the revisions made to the scheme,

(B) need to robust controls over the operation of the proposed retail floorspace.

It should also be noted that this conclusion is reached before the proposed mitigation measures (discussed below) are taken into account. This comprises our advice to CC and it will be now for CC officers and members to now reach their own conclusions on the issue of impact and its contribution to the overall planning balance, and we recommend that they do so by taking into account the above factors.

Suggested Mitigation and Conditions

4.9 In light of the above conclusion, we consider that there is certainly a need for mitigation in order to make the proposal acceptable in planning terms. Having reviewed the package of mitigation measures proposed by the applicant, we consider that they meet the tests for such measures in part 122(2) of the current CIL regulations and should all be sought by CC. Indeed, it may be that when CC officers and members reach their own conclusions on the issue of impact, they may wish to consider other mitigation measures, although any such measures will need to meet the CIL 122(2) tests.

4.10 In relation to controls over the proposed retail floorspace, we consider that the following are approach and necessary:

The foodstore unit should be limited to a net sales area of 1,254sq m with no more than 20% of this area being used for the sale of comparison goods.

The net sales area of the other large retail unit should be limited to 1,254sq m, with 45% of this area being used for convenience goods retailing and the remaining 55% being used for comparison goods retailing.

There should be no sub-division of the Class A1 retail units.

4.11 Finally, CC should seek legal advice to confirm

(A) whether a suitable legal mechanism, in a Section 106 agreement, can be found to formally link both applications in order that they may never be separated, and

(B) this provides adequate ‘mitigation’ for CC to conclude that non-compliance with the sequential test should not result in the refusal of Application 2 as advised by paragraph 90 of the NPPF.

via http://planning.cornwall.gov.uk/online-applications/files/573D90CF70391A...

- Printer-friendly version

- Login or register to post comments

- Permalink

Contributions

- Angarrack Defibrillator Team (25)

- Angarrack Inn (336)

- Angarrack Methodist Chapel (3)

- Carol (15)

- Gail (1)

- GordonG (12)

- Hayle Development Group on Facebook (5)

- Hayle Harbour Authority (4)

- Hayle Town Council (5)

- louise (1)

- Lynne (94)

- Mal (1)

- Neil (22)

- Neils Garden Care (9)

- Russell (21)

- Secretary - Christmas Lights (118)

- Steve (3)

- webmaster (5016)

Book page

tags in

Similar

- 190719 | Out of town Lidl and Home Bargains shopping centre looks set for approval

- PA18/06111 | Proposed mixed use development comprising three A1 retail (food and non-food) units and petrol filling station (inc

- 180104 | Lidl, KFC, Home Bargains and Starbucks retail park in Camborne meets opposition after Cornwall Council recommends alter

- 140416 | Is Hayle's new Asda going to be a 24 hour off licence? - Cornishman

- 121108 | Asda close to deal for store on South Quay | This is Cornwall

Similar across site

- PA18/06111 | Retail Planing Policy Supplementary Advice

- PA18/06111 | Proposed mixed use development comprising three A1 retail (food and non-food) units and petrol filling station (inc

- 190719 | Out of town Lidl and Home Bargains shopping centre looks set for approval

- 180104 | Lidl, KFC, Home Bargains and Starbucks retail park in Camborne meets opposition after Cornwall Council recommends alter

- 140416 | Is Hayle's new Asda going to be a 24 hour off licence? - Cornishman

Recent comments

35 weeks 3 days ago

37 weeks 1 day ago

37 weeks 1 day ago

46 weeks 6 days ago

1 year 7 weeks ago

1 year 31 weeks ago

1 year 41 weeks ago

2 years 1 week ago

3 years 26 weeks ago

4 years 11 weeks ago